CMMI Level 3

Delivering excellence with CMMI Level 3 certified processes.

ISO Certified

ISO 27001:2022 & ISO 9001:2013

Certified Dependable Software Solutions for Every Need

Experienced

Over 18+ Years of Expertise, Shaping the Future with Innovation

What We Do?

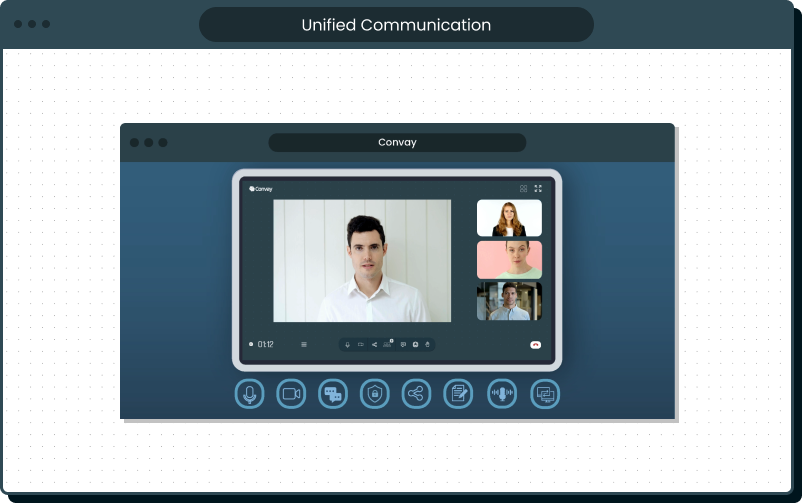

Conferencing Suite

Audio and Video Calling

Large-Scale Usability

Chat System

Automatic Transcription

File Storage and Collaboration

Custom AI Solutions

Tailored AI-powered solutions designed to address unique business challenges, enabling optimized workflows and enhanced decision-making.

Machine Learning

Natural Language Processing

Advance tools for understanding, processing, and responding to human language, improving communication through chatbots, sentiment analysis, and language translation.

Intelligent Automation

AI-driven automation tools that streamline repetitive tasks, boosting productivity while reducing human errors.

Seamless Integration

AI systems designed to integrate smoothly with existing technologies, ensuring minimal disruption and maximum compatibility.

Predictive Data Analysis

AI Based Security

Access to Specialized Talent

Scalability

Faster Time to Hire

Cost Efficient

Seamless Integration

Project Continuity

Flexible Contract Terms

Quality Assurance

Industry Specific Talent

Natural Language Understanding

Capable of comprehending and processing human language, including context, intent, and nuances, to deliver meaningful responses.

Text Generation

Produces coherent, context-aware, and creative written content for diverse applications, from summarization to storytelling.

Multilingual Support

Supports multiple languages, enabling global accessibility and communication across linguistic barriers.

Knowledge Retention

Utilizes pre-trained data to provide informed and accurate outputs while adapting to domain-specific knowledge.

Contextual Awareness

Handles long conversational histories or documents, maintaining contextual consistency in interactions and outputs.

Customizability

Fine-tuned for specific industries or tasks, such as customer support, education, or research, to meet specialized requirements.

Scalability

Data Backup and Recovery

Global Accessibility

Seamless Integration

Collaboration Tools

High Security

Smart Device Integration

Real-Time Monitoring

Seamless Connectivity

Data Analytics

Remote Device Management

Scalable Architecture

Enhanced Security

Threat Detection & Monitoring

Proactive identification and real-time monitoring of potential cyber threats to safeguard systems and data from malicious activities.

VAPT Assessment

Comprehensive evaluation to identify, prioritize, and mitigate system weaknesses through vulnerability assessment and penetration testing before they can be exploited.

Network Security

Advanced measures to protect networks from unauthorized access, ensuring safe and uninterrupted data flow.

Data Encryption & Protection

Secure encryption protocols to safeguard sensitive data, both in transit and at rest, ensuring confidentiality and integrity.

Incident Response & Recovery

Rapid response mechanisms to contain and resolve cyber incidents, minimizing downtime and enabling swift recovery.

Firewall & Endpoint Security

Robust firewalls and endpoint protection systems to block unauthorized access and prevent endpoint vulnerabilities.

Cloud Security

Specialized solutions to protect cloud-based assets, ensuring data security, compliance, and privacy in cloud environments.

Compliance & Regulatory Support

Assistance in meeting industry standards and regulatory requirements to ensure legal and secure business operations.

Advanced Data Integration

Combine and process data from diverse sources, including databases, APIs, and IoT devices, for a unified analytical view.

Advanced Analytics

Use machine learning algorithms to forecast trends, anticipate outcomes, and identify opportunities for growth.

Data Cleaning and Transformation

Ensure data accuracy and reliability by removing inconsistencies, duplicates, and errors before analysis.

Interactive Visualizations

Leverage charts, graphs, and heatmaps to represent complex data intuitively, fostering better understanding and collaboration.

Customizable Dashboards

Leverage charts, graphs, and heatmaps to represent complex data intuitively, fostering better understanding and collaboration.

Scalable and Secure Architecture

Handle large datasets with ease and ensure data security through robust encryption and compliance with global standards.

Collaboration Tools

Share reports and visualizations with teams in real time to drive data-informed decision-making across the organization.

Custom UI/UX Design

Crafting user-friendly and visually appealing interfaces tailored to provide an intuitive and engaging user experience.

Cross-Platform Compatibility

Building applications that function seamlessly across multiple platforms, including iOS, Android, and web.

Scalable Architecture

Designing apps with scalable frameworks to accommodate future growth and increased user demand effortlessly.

Third-Party Integration

Enabling smooth integration with APIs, payment gateways, and other external services to enhance app functionality.

Robust Security

Implementing advanced security measures, including encryption and secure authentication, to safeguard user data and privacy.

Continuous Maintenance & Updates

Providing regular maintenance and updates to ensure optimal performance, fix bugs, and incorporate new features.

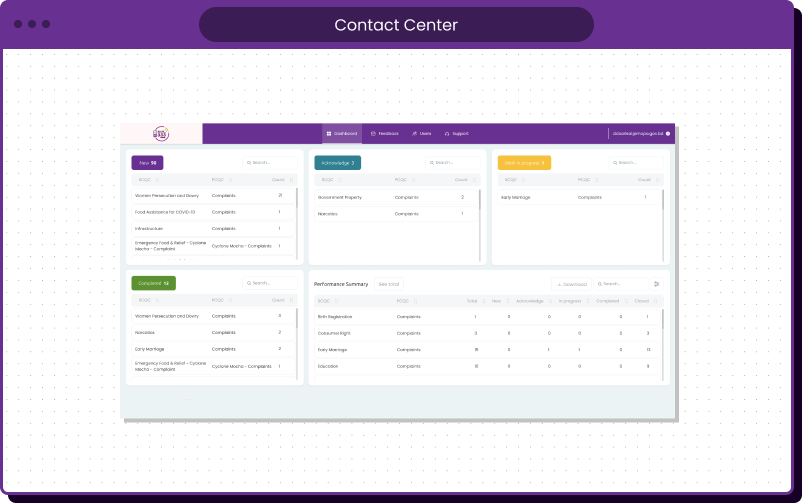

Multi-Channel Communication

Automated Features

Empowering Citizens

Advanced Analytics and Reporting

Workforce Management Tools

Industry-Standard Tailored Solutions

Elevating All Industries

At Synesis IT Ltd., we specialize in providing industry-standard tailored software solutions that meet the unique needs of diverse sectors. Our expert team combines deep industry knowledge with cutting-edge technology to deliver customized applications that enhance efficiency, streamline operations, and drive innovation. We are committed to helping businesses succeed in today’s dynamic landscape.

We love technology

Our clients love our results

Synesis IT collaborated with the National Board of Revenue (NBR) to develop groundbreaking solutions like eReturn, eTin, and EFDMS. These projects streamlined Bangladesh's tax administration, making tax returns, taxpayer registrations, and VAT collection easier and more efficient. The eTin system enabled online tax certificate issuance, while eReturn facilitated a seamless tax filing experience. EFDMS (Electronic Fiscal Device Management System) brought transparency to VAT collection by digitizing fiscal transactions. These solutions simplified compliance for millions of taxpayers, driving financial inclusion and digital transformation in taxation.National Board of Revenue (NBR), Bangladesh

For the Bangladesh Telecommunication Regulatory Commission (BTRC), Synesis IT developed the CBVMP (Customer Biometric Verification Management Platform). This platform revolutionized telecom customer registration by integrating biometric verification processes, ensuring regulatory compliance and eliminating fraudulent activities. The system streamlined the biometric SIM verification process for telecom operators, making it a crucial tool for securing digital identities in Bangladesh. This project has also been awarded the Asian Pacific ICT Award (APICTA) 2024.Bangladesh Telecommunication Regulatory Commission (BTRC), Bangladesh

Synesis IT partnered with the Ministry of Health and Family Welfare to create Shastho Batayon, Bangladesh’s first 24/7 health helpline. This telehealth platform provides citizens with medical consultations, mental health support. Shastho Batayon has played a crucial role during COVID 19 pandemic in Bangladesh. By connecting individuals with licensed doctors through phone and digital channels, Shastho Batayon has bridged the gap in access to healthcare, especially in rural areas.Ministry of Health and Family Welfare, Bangladesh

The Bangladesh Computer Council (BCC) benefited from Synesis IT’s innovative solutions like the National Job Portal and G-ERP. The National Job Portal connects job seekers with employers, fostering employment opportunities nationwide. Meanwhile, G-ERP digitized enterprise resource planning for government offices, improving efficiency in operations and resource allocation. Both initiatives significantly contributed to digital governance.Bangladesh Computer Council (BCC), Bangladesh

Synesis IT worked on innovative projects with a2i, including ekDesh, 333 Call Center, and the COVID-19 Telehealth Service Platform. ekDesh is a crowdfunding platform which enabled digital donations. 333 served as a one-stop helpline for citizens providing any services, from government information to social welfare. The COVID-19 Telehealth Platform provided critical medical support during the pandemic, saving countless lives by ensuring access to timely health services.

Synesis IT collaborated with the Department of Agricultural Extension (DAE) on projects like Phyto Sanitary and Contract Farming. Phyto Sanitary modernized the certification process for agricultural exports, ensuring compliance with international standards. Contract Farming facilitated agreements between farmers and buyers, promoting sustainable agricultural practices and ensuring fair trade.Department of Agricultural Extension(DAE), Bangladesh

For the Office of the Chief Controller of Imports and Exports (CCI&E), Synesis IT maintained and enhanced the Online Licensing Module (OLM). This platform streamlined import and export licensing, reducing manual paperwork and improving efficiency. With continuous support, Synesis ensured that trade operations ran smoothly for businesses across Bangladesh.Office of the Chief Controller of Imports and Exports (CCI&E), Bangladesh

Synesis IT supported the Prime Minister's Education Assistance Trust (PMEAT) by developing eStipend, a platform for automating educational stipend distribution. The system ensures transparency, accountability, and timely payments to deserving students, fostering education and reducing financial barriers for underprivileged learners.Prime Minister's Education Assistance Trust (PMEAT), Bangladesh

The Directorate of Secondary and Higher Education (DSHE) partnered with Synesis IT to develop the Education Management Information System (EMIS). This platform digitized data management for schools and colleges, enabling efficient monitoring of educational institutions and streamlining administrative processes.Directorate of Secondary and Higher Education (DSHE), Bangladesh

For Jiban Bima Corporation (JBC), Synesis IT implemented an Online Insurance System that made life insurance services accessible online. This platform digitized policy management, premium payments, and claims processing, enhancing customer convenience and improving operational efficiency.Jiban Bima Corporation (JBC), Bangladesh