EkPay

Introduction to the Project

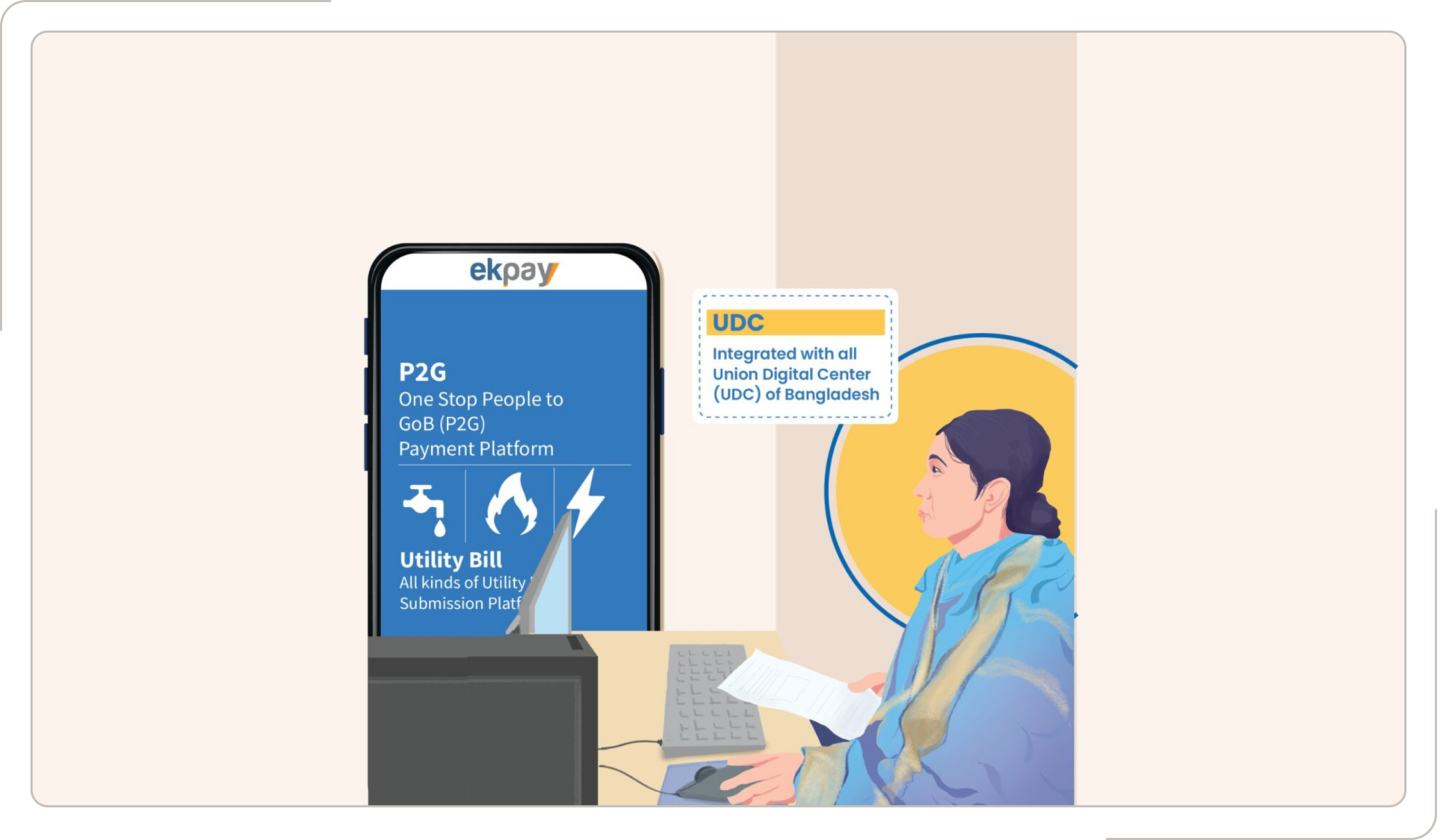

EkPay is the first and only Public to Government (P2G) Digital Payment Aggregator that aims to revolutionize payment by putting all utility bill payment services under a single window. The service was launched in November 2017 by a2i and Synesis It. It is a payment processor for Utility Bills, Student Payments, and P2G Payments such as Passport Office prices, Business Registration Fees, Vehicle Registration, Co-operative Society fees, and so on.

Challenges Before EkPay

Geographic and Accessibility Barriers

People, especially in rural areas, had to travel long distances to make utility payments, often facing significant inconvenience and time wastage.

Complex and Slow Processes

The payment process was characterized by long queues, confusing paperwork, and reliance on middlemen, leading to delays and additional costs.

Lack of Banking Access

Those without access to banking or mobile banking faced more difficulties, as they had to rely on cash transactions, which were insecure and time-consuming.

Inefficiency in Transactions

The absence of digital payment options made transactions slow and inefficient, particularly for the population without banking facilities.

Solution Overview

Project Launch

EkPay was developed as the first and only Public to Government (P2G) Digital Payment Aggregator, offering a centralized solution for government service payments.

Goal

The platform connects all banks, credit card processors, and mobile financial services, ensuring seamless and secure transactions across various payment methods.

Simplified Payment Process

EkPay provides a straightforward payment process where citizens can complete payments in just three steps, eliminating the need for intermediaries.

Instant Notifications and Secure Transactions

Users receive instant notifications upon successful payments, ensuring transparency and confidence in the transaction. The involvement of banks and financial services ensures secure, reliable transactions.

Key Features

Digital Payment Ecosystem

Digital Payment Platform

Ekpay provides a user-friendly platform for bill payments, supporting both web portals and mobile applications for easy access.

Payment Gateway

The system acts as a strong payment processor, facilitating the collection of utility bills and other service-related payments through secure transactions.

Instant Payment Confirmation

Upon payment, users receive instant confirmation via SMS, email, or a printable receipt, ensuring transparency and trust in the transaction process.

Biller Portal & Collection Management

A dedicated biller portal enables utility companies and service providers to manage payments and collections efficiently.

Government Agency Integration for Identity Verification

The platform integrates with government agencies for secure identity verification, enhancing the reliability of transactions.

Bi-Lingual Features

Ekpay supports Bangla and English languages, making it accessible to a wider demographic.

Hosting & Integration Support

The platform offers reliable hosting and easy integration with third-party systems and applications.

Admin Features

Complaint Management System (CMS)

Ekpay includes a comprehensive complaint management system to handle user queries and issues efficiently.

Data Visualization & Analytical Dashboard

Advanced data visualization tools, including a Management Information System (MIS) module and analytical dashboard, provide real-time insights into transactions and user behavior.

Custom Reporting & Workflow Management

The platform supports a custom report module and offers a robust workflow management system for better operational control.

Subscriber Profile Management

Users’ profiles are managed efficiently, ensuring secure handling of personal and transactional data.

Security, Exception Handling, & Configuration

The system incorporates advanced security measures, exception handling protocols, and master settings for configuration management.

Third-Party e-TIN Verification

Obtaining a TIN certificate took a considerable amount of time.

Historical & Audit Logs

The platform maintains historical and audit logs for transparency, compliance, and security monitoring.

Technology Platform

Angular

Swift

PostgresSQL

Java

InteliJ

Netbeans

CentOS

Webstorm

SQLite (Mobile App)

NagiOS

Android Studio

XCode

Core Expertise

Cyber Security

DevOps

Fintech

Impact

Widespread Reach and Market Growth

The project has significantly impacted the lives of citizens and various stakeholders, including Mobile Financial Services (MFS), banks, and billers. The P2G payments market, currently valued at 4,01,709 Crore BDT, is projected to grow substantially to 1,62,330 Crore BDT by 2025, indicating the system's growing influence.

Limited Digital Financial Adoption

Currently, only 7.7% of the population (about 30,931 Crore BDT) uses digital financial systems. However, the introduction of this system will enable people nationwide to access digital financial systems for government-related transactions.

Empowerment of the Unbanked Population

The EkPay system also benefits individuals who lack traditional or mobile banking facilities, enabling them to pay utility bills and other fees through the Unified Digital Channel (UDC), providing them with a digital payment option.

Simplified Payment Process

Citizens can now pay their bills in just three simple steps, improving convenience and reducing barriers to entry for digital payments.

Conclusion

Ekpay, developed by Synesis IT in partnership with a2i, has transformed the payment process in Bangladesh by providing a simple, secure, and centralized digital platform. It addressed the challenges people, especially in rural areas and those without banking access, previously faced. Now, citizens can easily pay their bills from anywhere, improving efficiency and convenience for everyone.