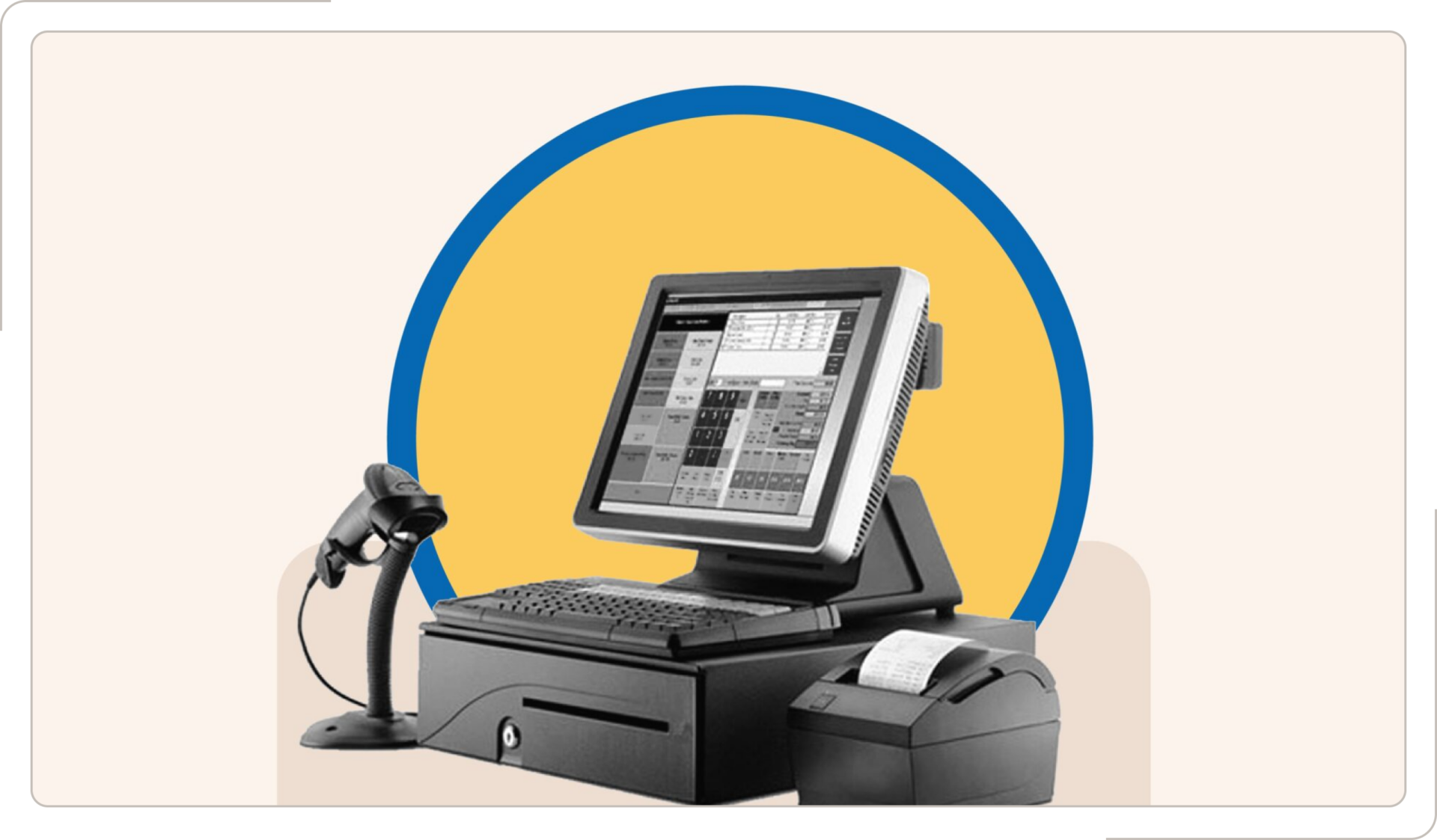

Electronic Fiscal Device Management Systems (EFDMS)

The Electronic Fiscal Device Management System (EFDMS) is a transformative solution designed to revolutionize VAT collection in Bangladesh. By capturing real-time transaction data from retail and wholesale outlets, the system addresses inefficiencies in VAT reporting and ensures greater transparency and accuracy in tax management.

EFDMS

Introduction to the Project

Developed in collaboration with the National Board of Revenue (NBR) and Synesis IT, EFDMS deploys Electronic Fiscal Devices (EFDs) and Sales Data Controllers (SDCs) to record and transmit transaction data securely. This creates a centralized, real-time platform for VAT tracking, reducing discrepancies and improving compliance.

Challenges Before Automation

Lack of Transaction Transparency

Retail and wholesale outlets lacked a standardized system to report transactions, making it difficult for the government to track and verify VAT payments accurately.

Disparity in VAT Collection and Deposit

The absence of transparency resulted in discrepancies between collected VAT and the amount deposited in government accounts, leading to revenue losses.

Tax Evasion Risks

Loopholes in the manual system allowed some businesses to evade taxes, further compounding the problem of revenue shortfalls.

Inefficient Refund and Collection Processes

The manual VAT reporting system caused delays in VAT receivables and refunds, often leading to disputes and inefficiencies.

Absence of Digital Infrastructure

The lack of a centralized digital platform limited the government's ability to monitor transactions in real time and enforce compliance.

Solution Overview

Project Launch

Synesis IT distributed Electronic Fiscal Devices (EFDs) and Sales Data Controllers (SDCs) to retail and wholesale outlets, enabling real-time transaction data capture.

Centralized MIS Integration

The system connects all devices to a centralized Management Information System (MIS), ensuring secure and accurate data transmission.

Real-Time VAT Tracking

Transaction data is recorded and transmitted instantly, allowing the government to monitor VAT collection effectively.

Simplified Reporting and Verification

Businesses can now report their transactions digitally, eliminating manual errors and streamlining the VAT refund process.

Key Features

System Infrastructure & Integration

Data Center & Network Connectivity

Established a Data Center (DC) with reliable network connectivity to ensure seamless operations.

Integration with NBR, Banks, & Retailers

Fully integrated with the NBR VAT system, Bangladesh Bank, and all retail outlets for real-time VAT processing.

High Transaction Processing

Capable of handling 2000 concurrent transactions per second (TPS), ensuring reliability even during peak usage.

Microservices Architecture

Built using microservices architecture, following BNDA standards for scalability and flexibility.

DC-DR Establishment

Established Data Center (DC) and Disaster Recovery (DR) systems to ensure business continuity and data security.

Platform Features & Support

VAT Online MIS Application Platform

Developed a comprehensive VAT Management Information System (MIS) for efficient VAT data handling.

Electronic Fiscal Device (EFD) Development

Implemented EFDs for automated VAT collection and reporting from retail outlets.

Mobile Application

Developed a mobile app for both NBR VAT officers and customers, enabling on-the-go access to VAT data and services.

24/7 Help Desk Support

Provides round-the-clock help desk and call center support for troubleshooting and inquiries.

Technology Platform

Java

MSSQL

Angular

Core Expertise

Cyber Security

DevOps

Microservices Architructure

Contact Center

Impact

Improved VAT Compliance

EFDMS has bridged the gap between VAT collected and deposited, ensuring timely and accurate reporting by businesses.

Enhanced Transparency and Accountability

The system reduces opportunities for tax evasion by securely recording all transactions and providing real-time data to the government.

Accelerated Refund and Collection Processes

The simplified reporting system minimizes disputes and speeds up VAT refund and arrears collection, benefiting both businesses and the government.

Reduced Revenue Losses

By identifying unpaid VAT and enforcing compliance, EFDMS has significantly reduced revenue losses for the government.

Operational Benefits for Businesses

Businesses benefit from a streamlined reporting process, allowing them to focus on operations while maintaining compliance with VAT laws.

Conclusion

EFDMS is a transformative solution for Bangladesh’s VAT ecosystem. This project not only supports the government’s efforts to improve revenue collection but also streamlines the process for businesses, creating a win-win scenario for all stakeholders involved.